What It’s Like To Raise A Seed Round In 2024?

In our co-founder’s Duke Urbanik‘s words:

Outlook for companies that need to raise capital in 2024 isn’t very friendly, while VC funds globally sit on a total of 355B$….

Maybe companies should look more at raising from strategic investors, however that needs a totally different approach.

Gené Teare from Crunchbase recently published a two-part series on the state of seed startup investing at the start of 2024. In the second part (full article available here) she looks at how the landscape has changed in the past decade, and specifically since 2021.

Below are some key points from the analysis:

- In the aftermath of 2021’s venture funding heyday and subsequent pullback, investors say that while seed funding has held up better than other startup investment stages, these very young startups will see lower valuations and must now clear a much higher bar to get backing.

- “Most first-time founders especially, and the vast majority of founders generally — they have to get significant traction to be able to raise that same round they used to be able to raise. And a lot fewer of those rounds are happening,” he said.

“A priced seed round of $3 million at $15 million [pre-money] is still happening, but you might have to be at $500,000 ARR, to raise that round now. Whereas in 2021, it was the norm to raise that round pre-revenue,” he said. - Series A fundings have gotten harder as “companies are going out and raising three seed rounds,” said Cardamone.

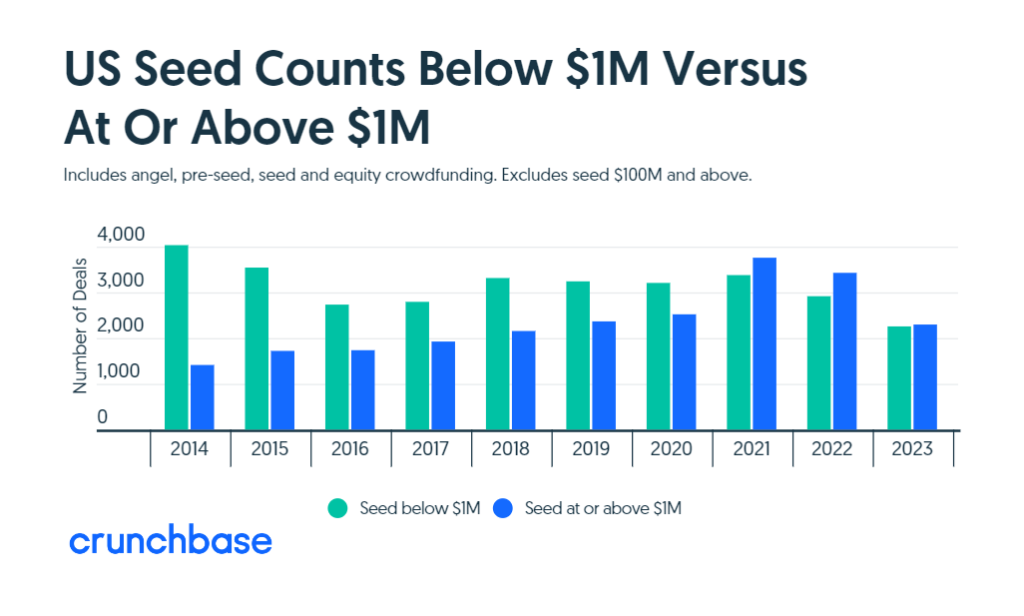

- Per an analysis of Crunchbase data, larger seed rounds — those $1 million and above — have increased through the decade.

- Seed below $1 million in 2014 represented around 25% of all seed funding. 2021 was a pivotal year. That’s when $1 million and above seed rounds outpaced smaller seed for the first time.

What this all shows is that seed has become an increasingly significant and elongated phase in a company’s early life cycle, where companies are raising multiple million-dollar seed rounds. And as of late, more companies than ever before are wading in the seed pool.

What does this mean for the seed funding market in 2024?

“I would expect Series A to start picking up, because if the premise is more and better companies are being funded this [past] year, they’re going to have to come back next year,” said Quintini.

Read the original article in its entirety here.

Want to hear more about our thoughts on the article? Drop us a line at hello@mastersofscale.nl.