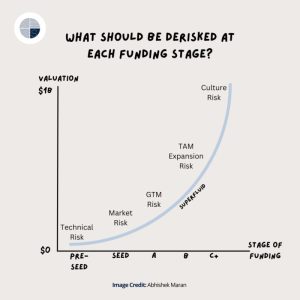

Fundraising stages are not just about the capital. They’re about risk. Understanding these risks will help you thrive.

Blog

Wise Lessons for Fundraising

During our Fundraising Strategy workshop, our Masters shared some wise lessons to keep in mind when fundraising

Startup Board Equity

How much equity should startup board members receive? Check out this insightful article from Markus Wagner to learn more

Techleap Pledge

Techleap’s budget has been halved and we have pledged to mentor founders to help continue the mission to create a healthy tech ecosystem

Ørsted Propel Program

We had the opportunity to work with the Ørsted Propel cohort over the last few months to coach and assess their scaling readiness

What is a SAFE Note?

A SAFE note is a founder friendly investment instrument originally coming from the US and being used more frequently in Europe nowadays.

The SVB Domino Effect

There is a major domino effect happening that resulted in the collapse of Silicon Valley Bank (SVB) and it's impact on the startup ecosystem is far from over.

Startup Changemaker

Our founding partner Tessa de Flines was interviewed by Leapfunder for their "Startup Changemaker" series. Learn how she is personally trying to make an impact in the entrepreneurial ecosystem.

Batten Down the Hatches!

Our Master Brad Furber shares why the fundraising landscape will continue to be extremely challenging for the balance of 2023.

2022 Ecosystem Research

We share an overview of research recently published on the startup and scaleup ecosystem and fundraising in 2022.

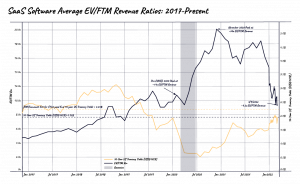

2022 VC Tech Funding Trends

We share a summary of Yannick Oswald's article of what happened in the tech funding landscape this past year and what he predicts will happen moving forward.

Improving Successful Scaling

A study from McKinsey showed that Dutch start-ups perform worse at scaling than leading countries globally.

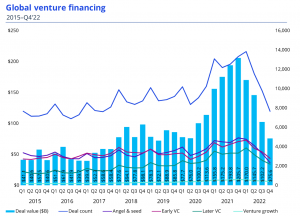

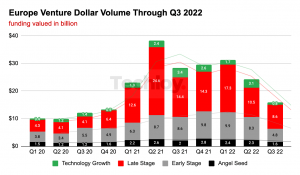

Investments Down in Q3 2022

We share a summary of the Q3 funding landscape in The Netherlands, Europe and the US. Worrying decline or a return to normal?

Fundraising in a Downturn

We share our views on fundraising in the current unfavorable economic climate. The good news? It's not all doom and gloom!

World Business Angels Investor Week

Our co-founder Dieuwke Hoogland moderated an all-female panel during the World Business Angels Investor Week.

Financial Investors vs. Strategic Investors

The difference between a financial investor and a strategic investor and which one is better for your company

Why investors don’t sign your NDA

You’re going to have plenty of challenges in attracting investors, don’t make forcing them down the NDA path one more reason to not get a pitch to begin with

How Not to Die

Y Combinator's Paul Graham shares his view on how not to die as a start-up in this article from 2007 which is still very relevant!

How to Run a Series A Fundraising Round

In this post we take a look at how to run a tight Series A process to help you get multiple competing term sheets, while not taking a lot of time.

How Much Capital Should You Raise?

When you are going out to fundraise you need to decide how much capital to raise. Investors are looking to fund a company to a milestone. Learn more in this article.

The Questions Venture Capitalists Will Ask Before Investing

Venture capitalists make decisions constantly about whether or not to invest in various startups. Read here about 15 key determining factors.