LinkedIn post from Peter Sorgenfrei

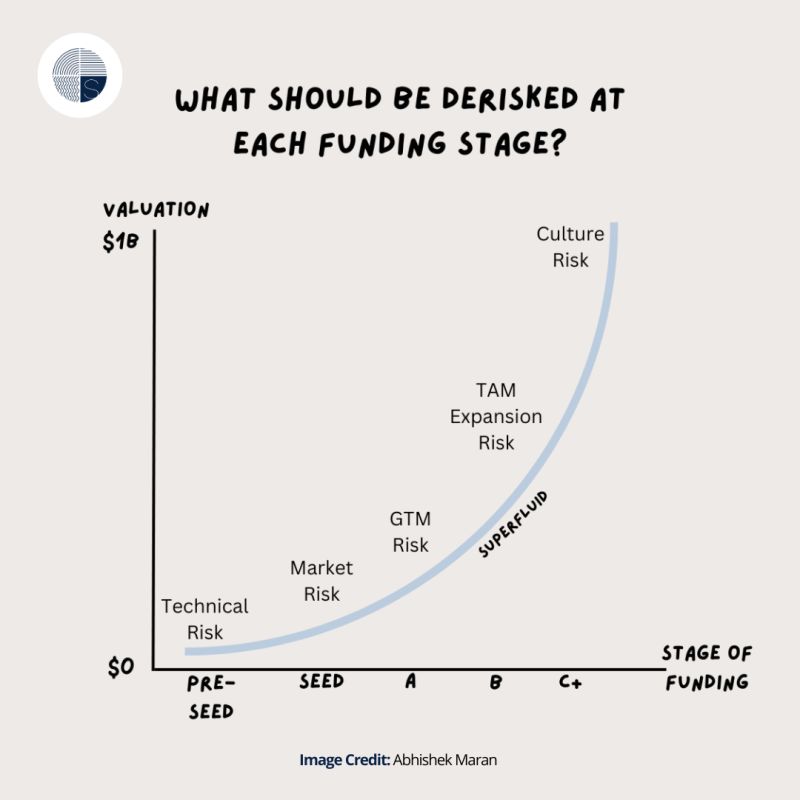

What Should Be Derisked at Each Funding Stage?

Fundraising stages are not just about the capital. They’re about risk.

Understanding these risks will help you thrive at each stage of your startup.

🚧 Pre-Seed

At this stage, you’re typically not generating revenue. So you need to understand the risks involved with product development and technical debt. Are you optimizing your costs as you build an MVP?

🚧 Seed

At this stage, you need to find your first customers. Who are they and are they willing to pay for your product and service? Investors will wonder if your market is even big enough to generate healthy returns.

🚧 Series A

At this stage, you need a reliable, predictable way of pouring money into customer acquisition. You need an effective go-to-market strategy that can capture your ideal customer segments.

🚧 Series B

From this point onwards, it’s going to be a high-speed race. A race to capture the most share in the market against bigger competitors. Are you able to expand, scale, and grow to optimize your target market?

🚧 Series C+

This is where founders are tested and turned into strong leaders. Are you able to build a startup culture that can support hundreds of employees? Are you able to maintain the core values you had when there were only a handful in the startup?

As you move up the fundraising stages, you’ll discover the new risks that come with growing your startup.

What most founders realize (sometimes too late) is that they can’t do it alone.

You need a mentor or advisor to help you successfully navigate your startup journey.

#leadership #leadershipdevelopment #CEO #founders

Want to hear our thoughts? Drop us a line at hello@mastersofscale.nl.