In this article, Yannick Oswald, Partner at Mangrove Capital and VC blog writer, gives a valuable summary of what happened in the tech funding landscape this past year, both in the public and private markets, and what he predicts will happen moving forward. Below you can find a summary:

What is happening in the market?

While 2022 should have just been a transition year to normalcy, the economic crisis now hit the last outposts of the tech world instead. Only the ‘crème de la crème’ with massive market potential will get valuations somewhat close to what we have seen in the last few years. The keyword is ‘short-term volatility’. But make no mistake, mid- to long-term, tech will continue to dominate and drive the majority of economic growth.

What is going on in the public markets?

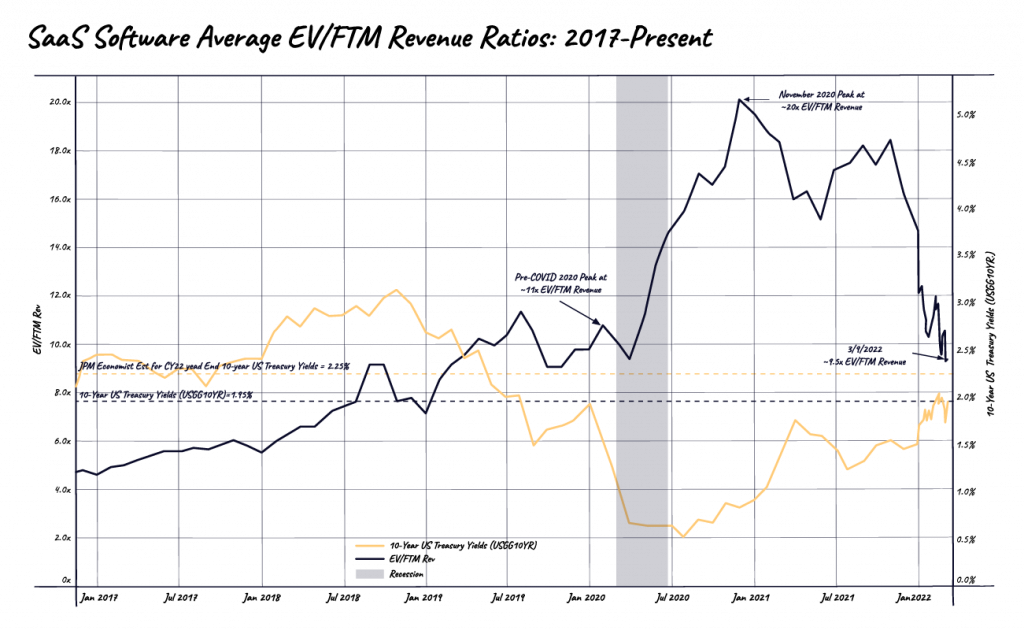

How did we get here? Riding the wave of cheap cash and accelerated growth driven by Covid, tech companies went on hiring binges and just accumulated too many ‘resources’ over the last years. Why? Well, to support the accelerated growth ambitions, and just because they could. Looking at the data, it is clear that valuation multiples for public tech were out of line with historical norms.

Tech is getting back in shape now. 2022 and 2023 will be the time when everyone moves from growth at all costs back to growth based on operational excellence and profitability.

By Q4 2023 / Q1 2024, public markets will acknowledge again that tech companies are just some of the best businesses out there. Private market funding should follow a year later or so.

What is happening in private markets?

In many cases, small startups, often pre-product market fit but raising vast amounts of capital, frequently hired rapidly ahead of revenue. The result is this: Aggressive spending on growth and massive inflation. There is more pain ahead for these overvalued private companies as most won’t raise at such favorable terms in the future. The economy should continue to cool in 2023 with the central banks’ anticipated continued rate hikes.

What is the state of VC funding?

European venture funding in Q3 2022 continues to fall, sliding to its lowest point in nearly two years. It is now clear that European VC firms across stages have scaled back their investment pace and we should expect the downward trend to continue further.

What does this mean for tech founders?

Great companies will still get funded, but we are all confused by the current environment. Closing a round takes longer, and valuations are lower. But they are still happening! This might be the best period in a long time to launch a new company. You don’t have to raise massive seed rounds anymore to be able to build your fundamentals. Deal structures are getting more complicated. But that is often to clean up the mess of the last years. You need to adapt your plan to weather the storm. There is more dry powder than ever but it is simply being deployed slower.

The Outlook: There is no room for long-term pessimism. Don’t let the current narrative become all-consuming.

Read the full article here.

Want to hear our thoughts? Drop us a line at hello@mastersofscale.nl.