Article and words by Anne Sraders

There’s a lot of talk about just how tough 2023 was for the European venture ecosystem — and now we have the data. And yes, it was bad.

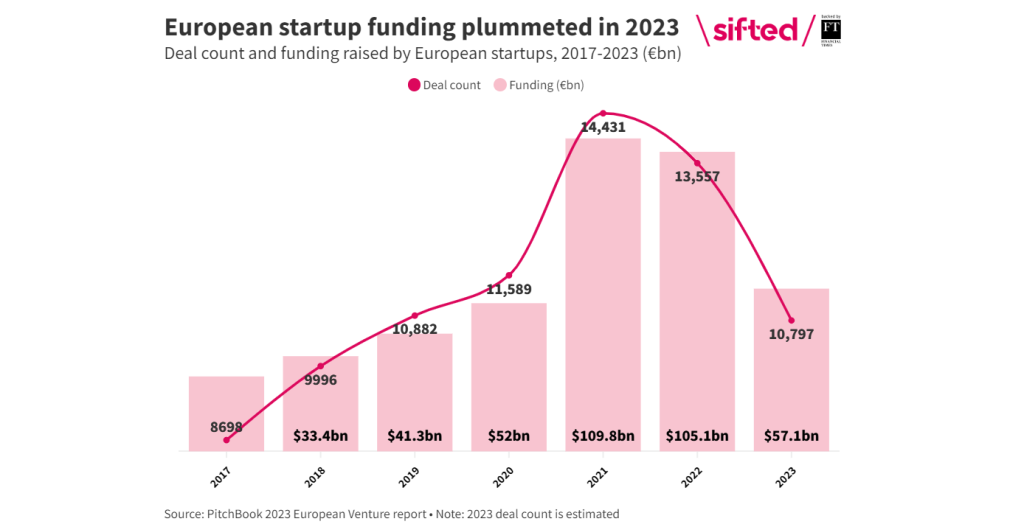

Deal value was down nearly 46% from 2022’s levels, at €57.1bn, according to a new PitchBook report out today. But on the bright side, if you exclude those two crazy years of 2021 and 2022, the trend is actually one of growth — deal value has been steadily increasing in Europe.

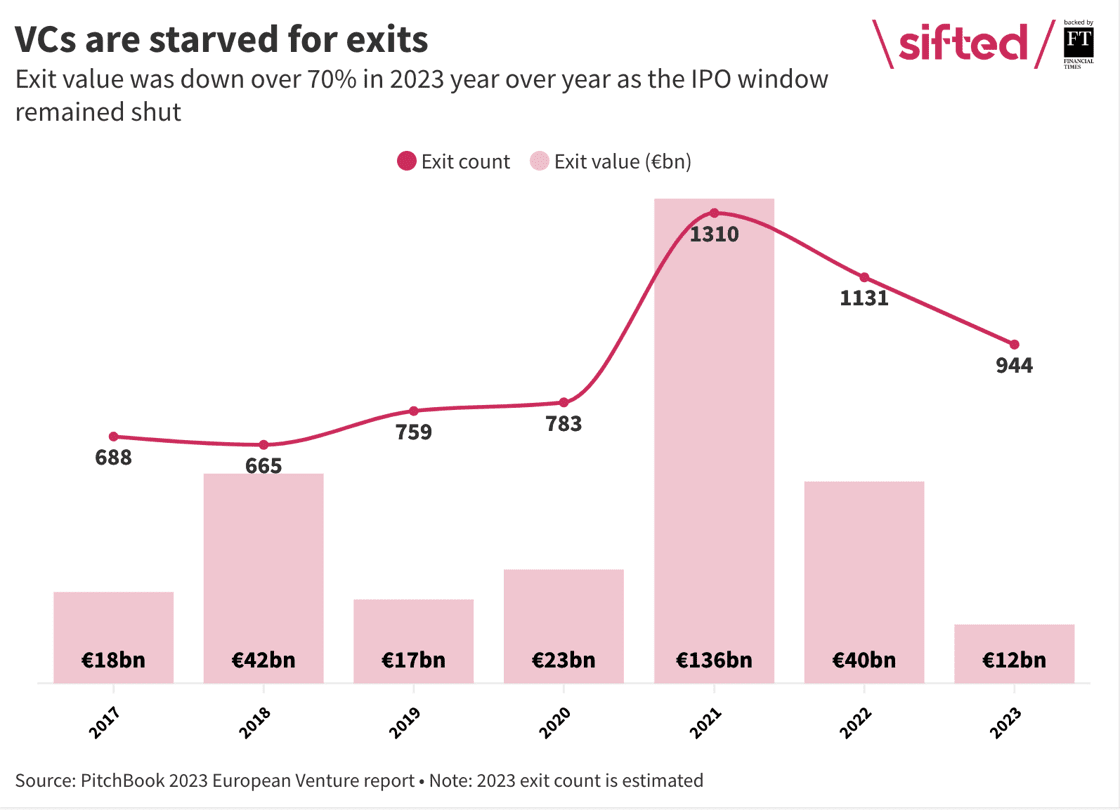

But, here’s the tricky part: exits — or, rather, the lack thereof — pose what I think is the biggest problem for VC in 2024. According to PitchBook, exit activity plunged to the lowest level since 2013 last year, with €11.8bn worth of exits — 70.9% lower than 2022. The vast majority of those exits were acquisitions.

|

Pretty much everyone I talk to these days is worried about the lack of exits and, consequently, the lack of returned capital to LPs. It means they don’t have as much capital to recycle back into new VC funds, which in turn, won’t have more money to invest into fledgling startups. This all won’t work itself out in one year (as I’ve said before, I don’t think 2024 is the year we return to what could be considered more “normal”), but it’s going to be a key topic in the coming months.

Of course, this is also a big conundrum for founders — and this year, startups may become more desperate for an exit if they can’t get a cash infusion from their investors. That might prompt some more fire sales to those lucky companies that have the means to snap them up. Plus, we’ll likely see more interest in secondaries as VCs grow more anxious to realise returns for their LPs.

Unfortunately, other exit options, like the elusive IPO, probably won’t offer much of a respite this year. “We expect no meaningful recovery in the value or volume of public listings in 2024,” writes PitchBook analyst Navina Rajan; the macroeconomic picture is still too weak. That means that the host of IPO-ready companies waiting in the wings might have to keep their plans on ice a bit longer.

Some VCs are more optimistic, though: Earlybird cofounder and partner Hendrik Brandis thinks we’ll see the “shy start of new transactions” in the second half of 2024, he tells me, adding that his own portfolio companies (those with money on hand, anyway) are continuing to look at acquisition opportunities.

It’s looking like founders will have a big year of decisions ahead of them: to sell or not to sell — or, to buy or not to buy?

Read the original article here!

Want to hear our thoughts on the article? Drop us a line at hello@mastersofscale.nl.